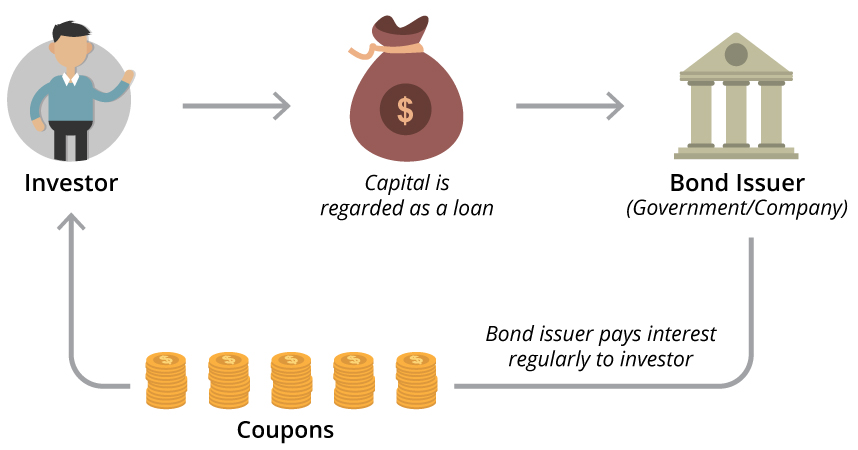

Welcome to RupeeSarthi, your go-to source for understanding the world of bonds and their significance in the investment landscape. Bonds are debt securities issued by governments, corporations, or other entities to raise funds. When you invest in bonds, you're essentially lending money to the issuer in exchange for periodic interest payments and the return of your principal amount upon maturity.

Bonds are known for their stability and income potential. They offer fixed interest rates, providing a reliable source of income, making them a preferred choice for income-focused investors. Government bonds, are considered the safest, while corporate bonds offer potentially higher yields with slightly more risk.

Understanding bond terms is vital. The face value represents the bond's principal amount, and the coupon rate is the interest rate paid to bondholders. Bonds have varying maturities, ranging from short-term (less than one year) to long-term (over 10 years), catering to different investment horizons.

Bond prices are influenced by interest rates and credit quality. When interest rates rise, bond prices tend to fall, and vice versa. Credit rating agencies assess the creditworthiness of bond issuers, helping investors evaluate associated risks.

RupeeSarthi is here to provide expert guidance on navigating the bond market, enabling you to make informed decisions aligned with your financial objectives. Whether you seek income, stability, or diversification, bonds offer a valuable addition to your investment portfolio. Your journey to financial success with bonds begins here, with RupeeSarthi as your trusted partner.