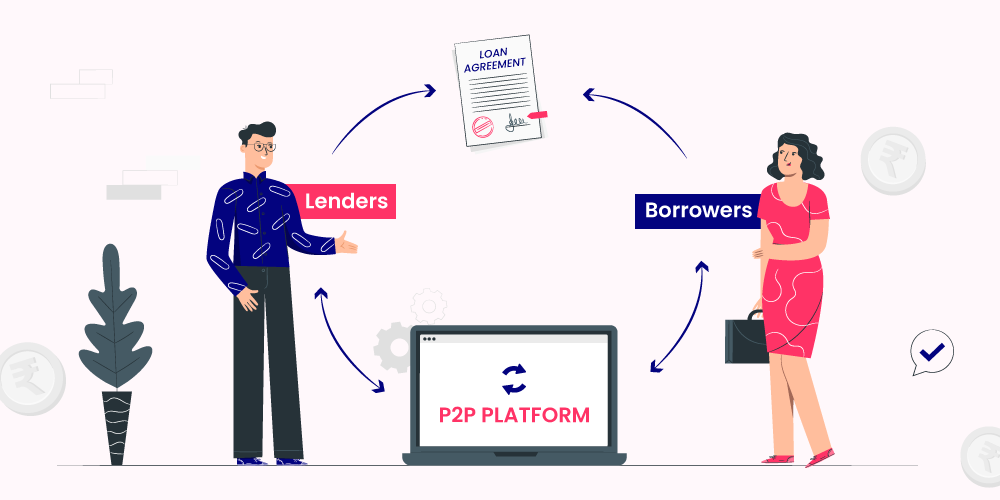

Welcome to RupeeSarthi, your source for insightful information on innovative financial solutions. Peer-to-Peer (P2P) lending is a rising star in the financial industry, offering a fresh approach to borrowing and lending money. P2P lending platforms connect individuals or businesses looking for loans with potential investors willing to provide funds, bypassing traditional financial intermediaries like banks.

The appeal of P2P lending lies in its efficiency and accessibility. Borrowers can often secure loans at competitive rates, while lenders can potentially earn attractive returns on their investments. This democratized lending model benefits both parties involved.

Investors can diversify their portfolios by lending to multiple borrowers, spreading risk across various loans. However, it's essential to understand the risks associated with P2P lending, including the potential for defaults and the absence of regulatory protection compared to traditional banking.

RupeeSarthi is your trusted guide to navigate the world of P2P lending. We provide expert insights and advice on how to assess the risks, choose the right platform, and make informed lending or borrowing decisions. Whether you're looking to grow your investments or secure a loan, P2P lending can offer an alternative path to financial success. Your journey into the world of P2P lending starts here, with RupeeSarthi as your financial companion.